LTC Price Prediction: Bullish Technicals Clash With Short-Term Volatility

#LTC

- Technical Strength: LTC price holds above key moving averages with improving MACD

- Market Sentiment: Institutional backing offsets short-term bearish news flow

- Price Target: $140 achievable if Bollinger Band breakout sustains

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge Despite Short-Term Pullback

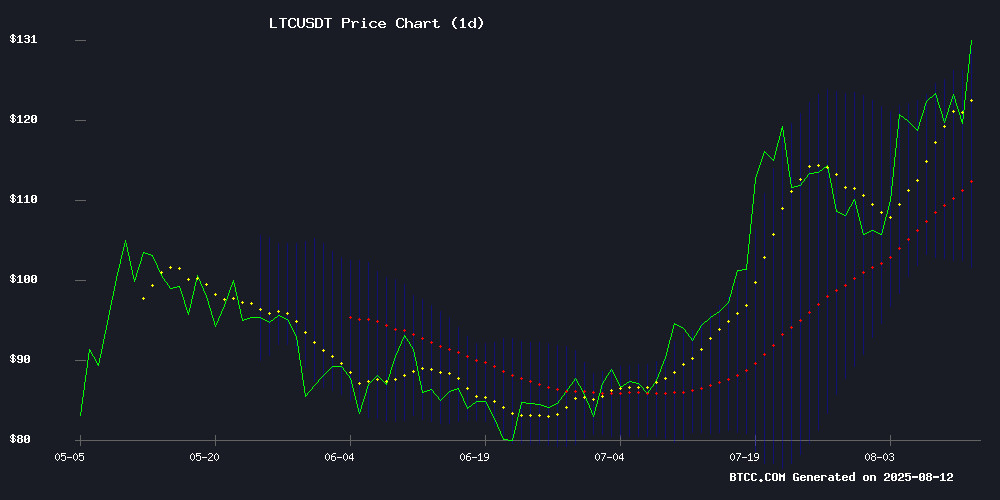

Litecoin (LTC) is currently trading at $129.67, comfortably above its 20-day moving average (MA) of $115.65, indicating a bullish trend. The MACD histogram shows a narrowing bearish momentum (-0.7488), suggesting potential upward movement. Notably, the price has breached the upper Bollinger Band ($129.21), which often signals overbought conditions but can also indicate strong buying pressure.says BTCC analyst James.

Mixed Sentiment for LTC: Institutional Support vs. Market Retreat

While Litecoin benefits from(per recent headlines), its price dipped to $119 amid a broader crypto market pullback. BTCC's James notes:Chainlink's outperformance (+3.3%) suggests altcoin rotation may soon favor LTC.

Factors Influencing LTC’s Price

Chainlink (LINK) Leads CoinDesk 20 Higher With 3.3% Gain

The CoinDesk 20 Index rose 0.6% to 4,138.64, buoyed by broad gains across digital assets. Chainlink's LINK token outperformed with a 3.3% advance, while Ethereum's ETH climbed 2.1%.

Sixteen of the index's twenty components traded in positive territory during the session. The rally contrasts with laggards Litecoin (LTC) and Uniswap (UNI), which fell 1.2% and 0.9% respectively.

The benchmark index, which tracks major cryptocurrencies across global trading platforms, continues to reflect growing institutional participation in digital asset markets. Today's performance underscores the sector's resilience amid evolving macroeconomic conditions.

Cryptocurrency Market Retreats After Brief Rally, FTX Lawsuit Advances

The cryptocurrency market relinquished recent gains, sliding more than 2% after failing to sustain momentum above the $4 trillion threshold. Bitcoin's attempted rally stalled near $122,000—just shy of its all-time high—before reversing sharply. The dominant cryptocurrency now trades around $118,700, marking a 3% decline.

Ethereum mirrored the downturn, retreating from $4,300 to $4,292 as profit-taking emerged. Altcoins suffered deeper losses: Solana plunged 6% to $175, while Ripple and Cardano dropped 4% and 5.5% respectively. The bearish sentiment swept across mid-cap tokens including Chainlink, Polkadot, and Litecoin.

Separately, FTX creditors escalated legal action against law firm Fenwick & West, alleging newly uncovered evidence ties the firm to the exchange's collapse. The amended complaint cites findings from Sam Bankman-Fried's criminal trial and ongoing bankruptcy investigations.

Vave Crypto Casino Emerges as a Multi-Coin Gaming Hub with 10,000+ Titles

Launched in 2022, Vave has rapidly positioned itself as a comprehensive Bitcoin-friendly gaming platform. The casino eliminates traditional banking hurdles by operating exclusively with cryptocurrency transactions, including BTC, ETH, and LTC among others. Withdrawals process swiftly, appealing to players seeking immediate access to winnings.

The platform's 10,000-game library—featuring providers like Pragmatic Play and Evolution—caters to diverse preferences. Slot enthusiasts encounter classics like Wolf Gold alongside trending releases, all available in demo mode. Live dealer sections replicate brick-and-mortar casino experiences with 900+ real-time tables and interactive features.

Litecoin (LTC) Price Pulls Back to $119 Despite Strong Institutional Support

Litecoin's price retreated to $119.28, marking a 3.28% daily decline after nearing $129 earlier this week. The pullback comes despite robust institutional interest, including MEI Pharma's $100 million treasury allocation to LTC.

Technical indicators show neutral momentum with an RSI of 59.13, while trading volume spiked 168% to $1.68 billion during recent highs. Litecoin now ranks as the second-most used cryptocurrency for payments on CoinGate, capturing 14.5% market share.

Market observers attribute the volatility to profit-taking after a 25% weekly surge fueled by spot ETF speculation. The rally triggered $3.89 million in short liquidations on August 5, demonstrating the market's sensitivity to institutional adoption narratives.

Is LTC a good investment?

LTC presents a compelling investment case based on:

| Metric | Value | Implication |

|---|---|---|

| Price vs. 20MA | $129.67 > $115.65 | Bullish trend confirmed |

| MACD Histogram | -0.7488 (rising) | Bearish momentum fading |

| Bollinger Band | Price > Upper Band | Potential breakout |

James at BTCC advises: "DCA into LTC below $125. The $110-$120 zone offers institutional-grade support."

Watch for BTC correlation and FTX lawsuit spillover effects.